STATE AUDIT OFFICE

-Press Release-

Skopje, 13 December 2022

Are government environmental policies effective?

Measures and activities taken by competent institutions are not sufficient for improving environment quality and rational use of natural resources

The State Audit Office conducted performance audit on the topic "Environmental taxes for effective implementation of environmental protection policies", in line with 2022 SAO Annual Work Program.

The scope and evidence obtained with implementation of audit techniques and audit methodology provided basis for the authorized state auditor to express the following conclusion:

Reasonable assurance was obtained that strategic and normative framework, compliance of national with EU environmental legislation, introduction of "polluter pays" principle and environmental fees and investments in individual areas provide certain progress in the implementation of policies. However, the above is insufficient for improving environment quality and rational use of natural resources.

According to the statistics, environmental taxes are classified into four categories: pollution taxes, resource use taxes, energy taxes and transport taxes.

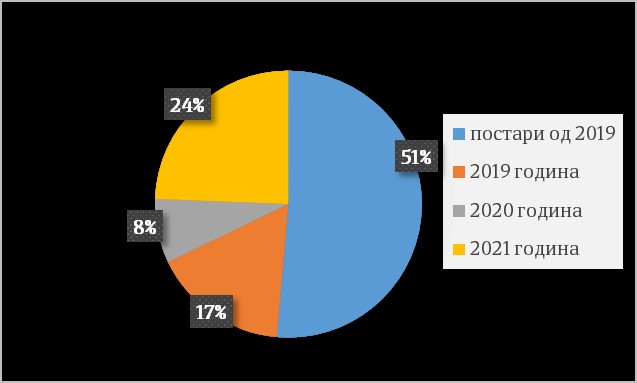

The audit covered pollution and resource use taxes and part of transport taxes for the period 2019-2021 amounting to 838.142.000 denars.

Auditors identified absence of integrated approach in solving environmental problems at national and local level. Administration of the environmental fees by several institutions does not facilitate inspection by the Ministry of Environment and Physical Planning (MoEPP), as responsible authority for implementation of the environmental policy.

Auditors ascertained that "polluter pays" principle is not obeyed in determining the amount of fees. Competent entities do not calculate the variable part of the fee for water discharge. There are fixed amounts of fees for waste management, the fees for integrated environmental permit are not within the legally defined limits by emission points, and municipalities do not have equal approach in determining basis for calculation of the service fee for collection, transport and disposal of municipal waste.

The audit report points to lack of single information system with information and data from all institutions involved in the process of calculation and collection of fees for regular institutional communication and coordination of data exchange. The State Environmental Inspectorate (SEI) has no legal authority to sanction taxpayers that have not paid the fee, which does not provide for effective administration of revenue from environmental fees.

For the period 2020 to the date of the audit, no revenue was generated in RNM Budget based on fees for use and discharge of water amounting to 101.616.000 denars, for which agreements were signed. The percentage of not charged water fee at national level is 60.46%, which is significantly higher than EU countries (30%).

Due to not issued/untimely issued decisions for payment of fee for possession of A-integrated license, and untimely and incomplete claims as of 31.12.2021, MoEPP has realized less revenue, i.e. uncollected receivables amounting to 9.453.000 denars, and written off receivable amounting to 30.273.000 denars.

Maturity structure of receivables

Only 37% of the municipalities generate revenue based on fees for municipal waste management, funds that should be used for implementation of regional plans and objectives for managing this area.

The Central Environmental Laboratory is not fully accredited, and due to not established cooperation with MoEPP, the State Environmental Inspectorate uses services of private accredited laboratories, which at the same time perform measurements and prepare reports on pollutants.

It is not possible to provide an indicator of the degree of utilization of funds from environmental fees in relation to financing environmental activities.

In the period 2019-2021, the programs for investing in environment have 62.7% realization and due to lack of measures taken by the contracting parties, the contracts for realization of projects from the Water Management Program in the amount of 6.520.000 denars were terminated.

MoEPP budget funds are not sufficient for financing activities in the area of air and nature protection. At local level, planned funds for environmental protection do not ensure realization of planning documents and implementation of activities in priority zones and agglomerations.

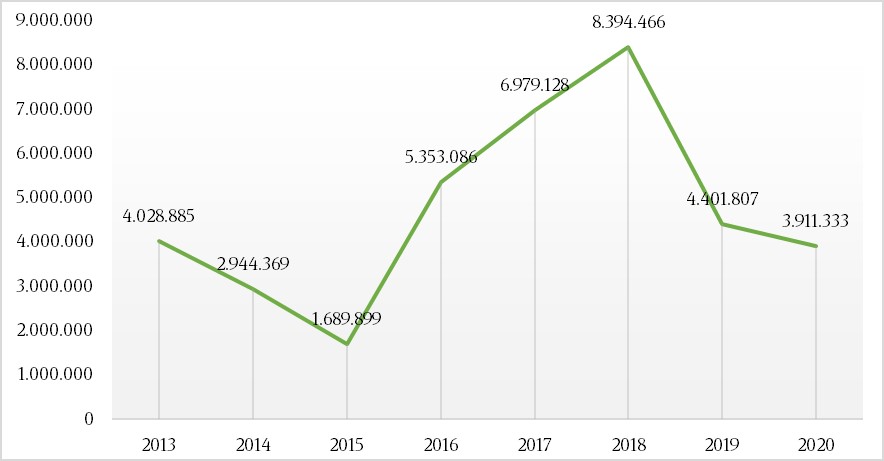

Source: State Statistical Office

Investments in environment (in 000 denars)

Due to lack of integrated approach in the distribution and use of environmental fees, according to data from the State Statistical Office, investments and costs for environmental protection have insignificant share of 0.6% in the GDP in 2020.

The audit objective was to answer the question: "Do environmental taxes contribute to improving environment quality and rational use of natural resources?"

The audit was carried out as a pilot audit within the EU financed Twinning Project with the SAIs of Bulgaria and Croatia.

Press contact:

Albiona Mustafa Muhadziri +389 72 228 203 [email protected]

Mijalche Durgutov +389 70 358 486 [email protected]

Martin Duvnjak +389 75 268 517 [email protected]