STATE AUDIT OFFICE

Press release

Skopje, 16.03.2022

Increased revenue of Pension and Disability Insurance Fund not sufficient to cover 2020 deficit for payment of social benefits

The increased revenue of the Pension and Disability Insurance Fund is not sufficient to cover the deficit for payment of social benefits in 2020, which are allocated from the Budget of RNM and participate with 38.4% in the total revenue of the Pension and Disability Insurance Fund

The State Audit Office carried out audit of the financial statements for 2020 together with compliance audit on the Pension and Disability Insurance Fund of North Macedonia (PDIF).

The certified state auditor expressed qualified opinion on the true and objective presentation of financial standing and results of financial activities, and qualified opinion on the compliance of financial transactions with relevant legislation, guidelines and policies in place.

Auditors ascertained weaknesses in the system of internal controls in the process of exercising PDI rights and payment of pension, lack of complete division of competencies and responsibilities of employees, which results in unconfirmed data and inaccuracy and untimeliness of the procedure. Ultimately, it increases the risk of irregularities in the procedure for recognizing PDI rights as well as the risk of payment of pension after the expiration of the legally established right.

The audit report discloses the following shortcomings:

- lack of professional and trained actuaries resulting in lack of actuarial analyses for the situation in the pension system, and the permanent outflow of IT and internal audit employees affects the functioning of the information system and the effectiveness of the internal control system;

- weaknesses in storing and archiving data in the registry records prevent verification of reliability and completeness of registered data, which are essential for realization of PDI rights;

- not allocated funds from collection of PDI contributions due to not received appropriate data for employment and registration of taxpayers and errors in data entering by other institutions, cannot be used by PDIF and the insured persons cannot exercise PDI rights;

- insufficient mechanisms for forced collection of damage due to unfounded payment of pensions result in claims from citizens and low percentage of return of overpaid funds;

- recorded properties without credible document, unsettled property relations and uncompleted registration in the real estate cadaster;

Emphasis of Matter and Other Matter:

- unjustified withdrawal of funds from PDIF account by enforcement agents based on enforcement orders where pension beneficiaries are debtors, and continuous PDIF activities for realization of enforcement orders;

- increase of deficit for payment of pensions, as well as uncertainties in PDIF operation related to the inflationary movements and unfavorable demographic movements; and

- the system for determining, controlling and collecting contribution is not based on complete updated and accurate integration and timely exchange of data with the institutions, which affects the completeness of PDIF revenue and liquidity as well as the sustainability of the pension system.

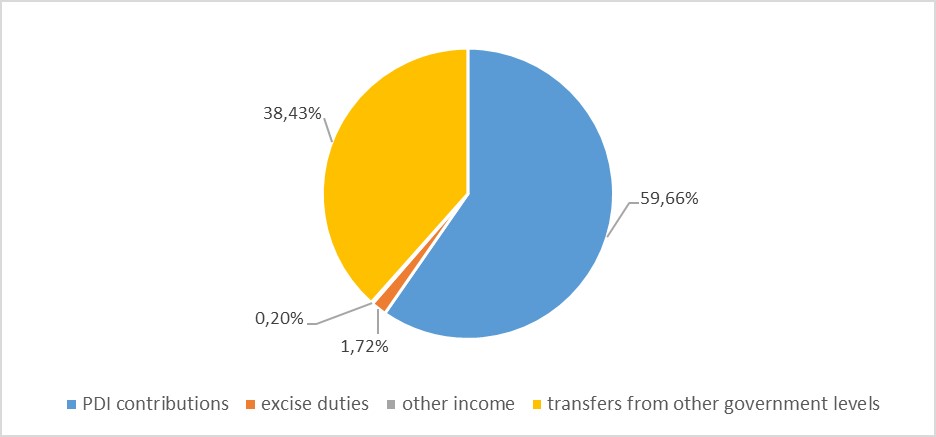

The following graph presents the structure and level of realized revenue in 2020 amounting to 77.68[1] million denars

Source revenues, i.e. revenues from collected PDI contributions in 2020 have increased by 10.5% compared to 2019, and amounted to 46.34[2] million denars (59.66% in the total revenue). However, the increase in revenue in 2020 is still not sufficient to cover the expenditures for social benefits, which also increase each year (payment of pension together with health insurance contributions for pensioners, transfers to the second pension pillar and disability). The social benefits amounted to 76.80 million denars for 326.295 beneficiaries of pension and as of December 2020, the payments are 5.6% higher compared to 2019.

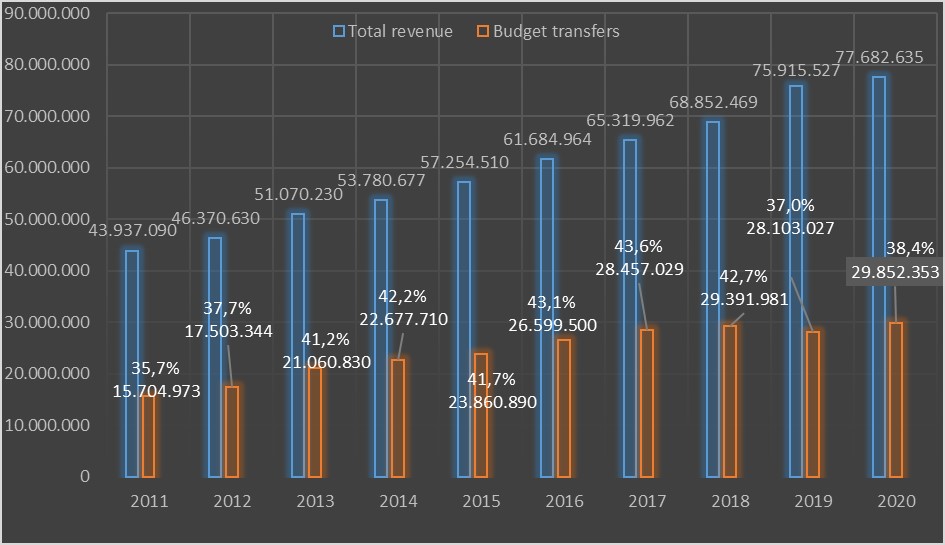

Due to deficit of funds for payment of expenditures for social benefits, 29.85 million denars were transferred from the Budget of RNM in 2020. The share of these funds in the total PDIF revenue has increased from 37% in 2019 to 38.4%. 28.7% of these funds are used for covering the deficit for payment of pensions.

Graph 2: Share of transferred funds from the Budget of RNM in the total PDIF revenue

The audit highlights the impact of the energy crisis on the operation of many legal entities in our country, which resulted in layoffs that reduce the amount of PDIF source revenues realized from collection of contributions from employees. The inflation also has an impact on PDIF operation given the legal obligation for adjustment of the pension with the increase in retail prices.

Consequently, it is expected that in the long run, PDIF financial operation will remain burdened by the current problem of high deficit that is covered by transfers from the Budget of RNM.

PDIF and the competent ministries need to take on activities for development of actuary and pension forecasting capacities with coordinated activities for adoption of legal solutions that would contribute to reduction of expenditures for social benefits. In addition, regulating PDI contribution and full collection of the same are the segments for stabilization of the pension system, which would ultimately have an impact on the reduction of the share of transfers from the Budget of RNM in the total PDIF revenue.

Press contact:

Albiona Mustafa Muhadziri +389 72 228 203 [email protected]

Mijalche Durgutov +389 70 358 486 [email protected]

Martin Duvnjak +389 75 268 517 [email protected]

[1] The total revenue presented in PDIF financial statements for 2020 is 82.137.415.000 denars and it contains the transferred surplus of revenue from the previous year amounting to 4.454.780.000 denars.

[2] The report on the Central Budget of RNM presents the amount of 46.62 million denars. The difference of 284, 45 million denars occurs due to remittances after 31.12.2020, which are not recorded in the business books of the Fund for 2020.