STATE AUDIT OFFICE

Press release

Skopje, 16.02.2022

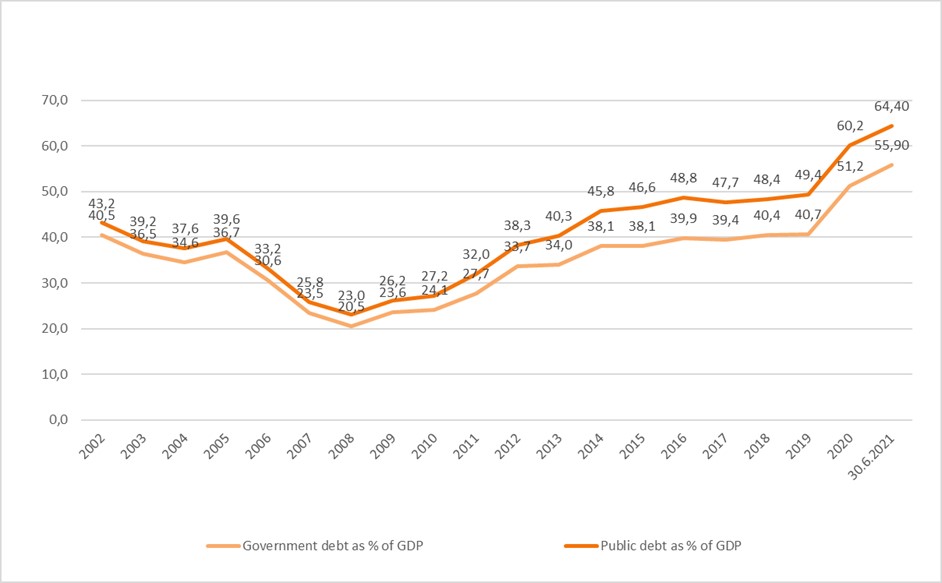

Public debt reached 60% of GDP

In conditions of global pandemic induced by COVID-19, the limit of public debt reached 60% of GDP and the debt increased by 15 percentage points. In response to the health and economic crisis, Republic of North Macedonia as other countries has not always ensured compliance with fiscal rules on public debt and deficit management and thus there is an increase of public debt in many countries worldwide.

The State Audit Office carried out performance audit entitled "Public Debt Management - Borrowing of the Republic of North Macedonia".

The audit was performed in accordance with SAO 2020 Annual Work Program and covered the period 2015-20, although certain areas, issues and events covered the period before 2015 until the date of reporting on the audit.

The audit was carried out to answer the following questions:

- What is the effect of the fiscal policy through the budget deficit and the management of public investments financed by borrowing on public debt?

- Is the public debt, increased by 15 percentage points of the GDP during COVID-19 crisis and reached the limit of 60% of GDP, sustainable?

- Does the public debt management system enable efficient management of the public debt of RNM by providing funds for financing the state budget at the lowest possible cost in the medium and long term and with sustainable risk level, as well as by issuing state guarantees with sustainable risk level and maintaining efficient and liquid government securities market?

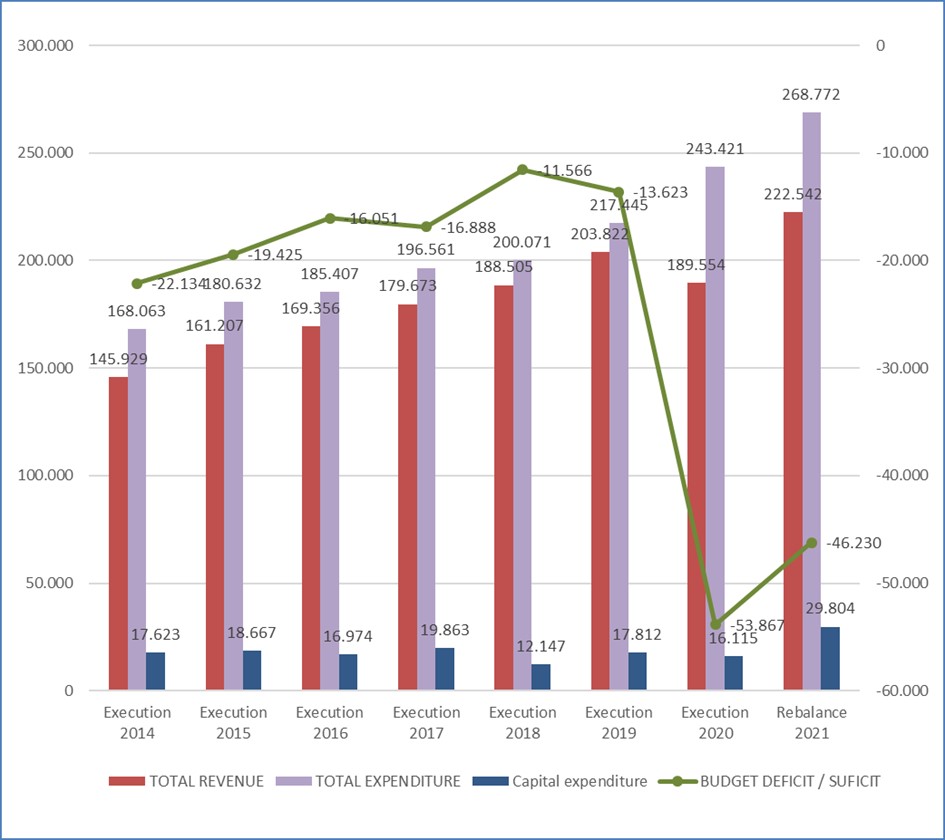

The audit report highlights the impact of the fiscal policy on public debt creation. In the Republic of North Macedonia 75% of the total public debt, i.e. 88% of the state debt is for financing the budget deficit due to projected higher expenditure than revenue.

The authorized state auditor emphasizes the need to apply international best practice, which are not provided for in the Constitution of RNM and the Law on Budgets, such as fiscal rules on public debt and deficit, performing mandatory debt sustainability analysis in the Budget adoption procedure, as well as a borrowing plan by the Parliament.

Significant reforms in public financial management are envisaged with the Public Financial Management Reform Program 2018-2021, document supported by EU funds. For the subsequent period, the process of adoption of the Public Financial Management Reform Program 2022 - 2025 is in the final phase.

The draft Law on Budgets, which is in parliamentary procedure, envisages fiscal rules and setting up of a Fiscal Council, as an independent body that makes analyses and provides opinion on the fiscal policy before the Assembly of RNM.

Chart 1: Processed data published on the website of the Ministry of Finance by the Treasury Department on Revenues, Expenditures, Capital Expenditures and Budget Deficit in the Budget of RNM for the period 2014-2020.

The authorized state auditor found that the absence of a separate law / bylaw or strategic document for public finance management in exceptional circumstances / crisis or emergency poses a risk to the public debt management.

In the Republic of North Macedonia in the Covid 19 crisis, public debt increased by 15 percentage points of GDP and public debt limit of 60% of GDP was reached, which may call into question the prudent management of public debt and the sustainability of the public debt in the future.

Chart No. 2 Status of public and government debt as a percentage of GDP

The possibility of borrowing for financing budget deficit for the current and the next two years provides for adoption of borrowing decisions when market conditions are most favorable, and thus efficient management of the public debt of RNM.

However, it should be emphasized that the process of Budget preparation does not envisage adoption of a special borrowing plan by the Assembly of RNM, while the procedures for issuing Eurobond, negotiating terms of the loan and granting on-lending loans to public debt holders are not fully regulated in the legislation, bylaws or internal procedures.

The authorized state auditor also noted small percentage of realization of capital projects. This is due to selection of projects without precise and clear criteria, unforeseen project selection methodology, implementation of projects that are not within the budget process, as well as the absence of monitoring and supervision of projects. Such conditions have an effect on the efficient, effective and economic use of public funds and public debt management.

Borrowing with bilateral loan for construction of highways depends on the conditions set out in the Agreement for construction, which was adopted by the Assembly of RNM as a separate law. For this borrowing, the authorized state auditor points to the need for reclassification of guaranteed into government debt. In addition, the Department for international financial relations and public debt management in the Ministry of Finance has insufficient capacities, which affects the efficiency of public debt management.

The scope and evidence provided with the implementation of audit techniques and methodology provide basis for expressing the following conclusion:

The public debt management system, with the exception of certain shortcomings, provides for efficient management of the public debt of the Republic of North Macedonia. The opportunity for borrowing to finance budget deficit for the current and the next two years, provides for adoption of borrowing decisions when market conditions are most favorable, but there is a risk of borrowing that is not approved by the Assembly of RNM.

The process of Budget preparation does not envisage adoption of a special borrowing plan by the Assembly of RNM, while the procedures for issuing Eurobond, negotiating terms of the loan and granting on-lending loans to public debt holders are not fully regulated in the legislation, bylaws or internal procedures. Borrowing with bilateral loan for construction of highways depends on the conditions set out in the Agreement for construction, which was adopted by the Assembly of RNM as a separate law and this borrowing requires reclassification of guaranteed into government debt.

Insufficient capacities of the Department for international financial relations and public debt management in the Ministry of Finance and its institutional setup have an effect on the efficiency of public debt management.

Press contact:

Albiona Mustafa Muhadziri +389 72 228 203 [email protected]

Mijalche Durgutov +389 70 358 486 [email protected]

Martin Duvnjak +389 75 268 517 [email protected]